Why Bookkeeping Services Calgary keep your financial health strong

Wiki Article

Discover the Crucial Function of an Accountant in Local Business Success

In the affordable landscape of small company, the function of an accountant frequently goes unnoticed yet stays vital. They give necessary solutions that guarantee economic precision and compliance. Effective bookkeeping can illuminate a business's economic wellness, leading owners towards informed decision-making. Nonetheless, lots of proprietors forget this vital source. Recognizing the full influence of a bookkeeper's expertise exposes chances that can significantly influence the trajectory of a business's success. What may be lurking in the numbers?Comprehending the Basics of Accounting

Although many little service owners might view bookkeeping as a tedious task, comprehending its fundamentals is crucial for keeping financial health and wellness. Bookkeeping involves methodically videotaping economic transactions, which prepares for informed decision-making. At its core, it incorporates tracking income, properties, responsibilities, and costs. By carefully maintaining these records, little organization owners can obtain insights into their monetary efficiency and capital.In addition, grasping the essentials of accounting aids in preparing for tax commitments and making sure compliance with guidelines. Familiarity with monetary statements, such as revenue declarations and equilibrium sheets, enables company owner to analyze success and economic stability (Best Bookkeeper Calgary). Carrying out efficient bookkeeping techniques can lead to better budgeting and forecasting, eventually adding to long-lasting success. Investing time in understanding accounting basics outfits tiny organization owners with the needed devices to browse their monetary landscape successfully, eventually boosting their total business acumen.

The Financial Health And Wellness Check: Why Accurate Records Issue

Accurate monetary records act as the foundation of a little business's financial health. They give a clear photo of a firm's income, expenses, and total profitability. By preserving exact records, company owner can identify patterns, take care of capital, and make educated choices. Inaccuracies in economic documentation can lead to costly mistakes, misinformed methods, and potential lawful concerns.Regular monetary medical examination, promoted by a knowledgeable accountant, guarantee that inconsistencies are resolved quickly, fostering confidence amongst stakeholders. Additionally, precise records are vital for tax preparation, assisting stay clear of charges and taking full advantage of reductions.

Reliable economic data can enhance a company's credibility with lenders and capitalists, leading the way for future development opportunities. Eventually, focusing on accurate record-keeping not just safeguards an organization's current condition but additionally lays the foundation for lasting success.

Budgeting and Projecting: Planning for Success

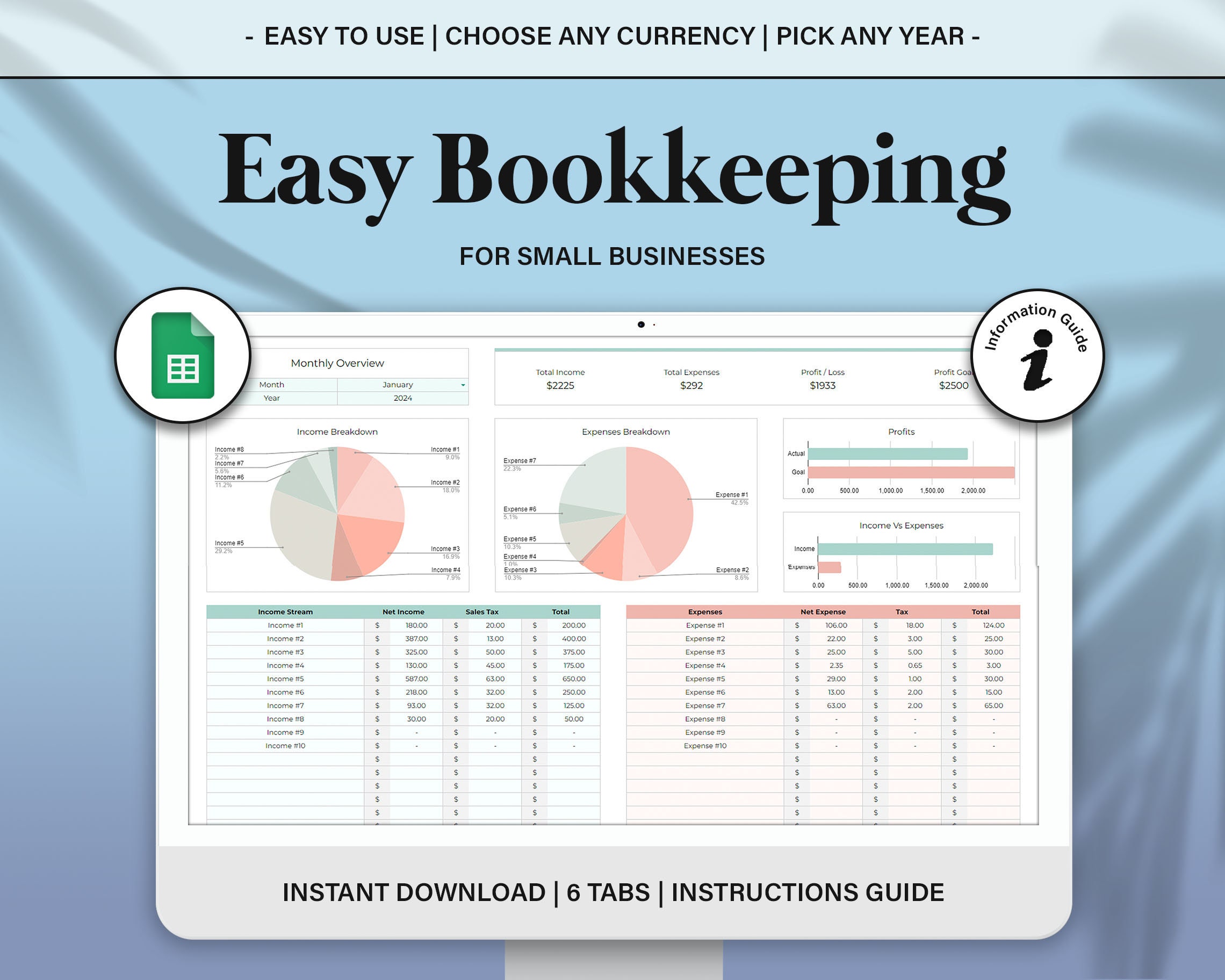

Effective budgeting and forecasting are important tools that empower small service owners to browse their economic landscape with self-confidence. By developing a clear financial plan, companies can designate resources successfully, expect future costs, and determine potential profits streams - Best Bookkeeper Calgary. A well-structured spending plan serves as a roadmap, assisting decision-making and ensuring that business continues to be on track to fulfill its financial objectives

Projecting enhances budgeting by offering projections based upon historic data and market fads. This anticipating evaluation allows local business to prepare for changes in cash circulation and change their methods as necessary. Routinely updated projections assist owners make notified selections regarding investments, employing, and expansion possibilities.

Together, budgeting and projecting allow tiny services to seize and decrease risks growth chances, eventually adding to long-lasting success. Involving an accountant to help in these procedures can improve accuracy and integrity, making sure that the economic foundation is strong and knowledgeable.

Tax Compliance and Preparation: Keeping You Informed

A solid monetary strategy not only incorporates budgeting and projecting yet likewise encompasses tax obligation compliance and prep work. For little businesses, understanding tax commitments is essential to stay clear of penalties and ensure economic wellness. An accountant plays a vital role in this procedure by maintaining exact records of revenue, costs, and deductions, which helps in precise tax obligation filings. They remain updated on tax obligation regulations and guidelines, making certain business abide by neighborhood, state, and federal demands.In addition, accountants aid identify tax-saving chances, encouraging on allowable reductions and credit ratings that can favorably influence the bottom line (Best Bookkeeping Calgary). By preparing tax obligation returns and handling target dates, they relieve anxiety for entrepreneur, allowing them to concentrate on procedures. With their experience, small companies continue to be notified concerning their tax obligation standing, fostering a positive approach to financial monitoring and long-lasting success

Financial Reporting: Making Informed Service Decisions

Exact economic data is crucial for little companies, acting as the structure for audio decision-making. When they need it, the timing and frequency of economic reporting play considerable duties in making certain that service proprietors have accessibility to pertinent details. By leveraging data-driven understandings, services can browse challenges and seize chances better.Value of Accurate Information

Timing and Regularity Matters

Timeliness and frequency in financial coverage are vital for effective decision-making in small companies. Regular economic reports guarantee that entrepreneur have access to up-to-date details, enabling them to react promptly to transforming market problems. Quarterly or monthly coverage enables ongoing assessment of financial efficiency, highlighting trends and possible problems before they rise. This organized method not only aids in cash money circulation administration however likewise supports budgeting and forecasting efforts. Furthermore, prompt records foster transparency and responsibility within the company, improving stakeholder trust. Without consistent economic oversight, local business run the risk of making uninformed decisions that can threaten their development and sustainability. Developing a reputable coverage schedule is crucial for keeping a healthy financial overview.Data-Driven Decision Making

Just how can little companies flourish in an affordable landscape? By leveraging data-driven decision-making, they can attain significant development and functional performance. Precise monetary reporting, helped with by skilled accountants, gives vital insights right into income patterns, costs, and capital. This details encourages local business owner to identify fads, allot sources carefully, and adjust methods in real-time.Timely financial reports make it possible for small services to anticipate future efficiency and make informed selections relating to investments and cost-cutting efforts. As an outcome, the capacity to evaluate and analyze economic information comes to be a cornerstone of tactical planning. Eventually, companies that harness the power of information are better positioned to navigate challenges and confiscate chances, guaranteeing long-term success in a vibrant market.

Streamlining Workflows: The Effectiveness of Outsourcing

As businesses undertaking for efficiency and development, outsourcing particular operations has actually arised as a critical option that can substantially improve processes. By entrusting non-core tasks, such as accounting, to specific companies, local business can concentrate on their main goals. This strategy decreases overhead expenses, as hiring internal personnel typically entails incomes, advantages, and training expenses.Outsourcing permits access to experience that might not be readily available internally, guaranteeing that jobs are done with a high level of skills. Additionally, it boosts versatility, allowing services to scale procedures up or down based on demand without the problem of permanent staffing modifications.

Outsourcing can improve turn-around time for essential functions, as exterior carriers often have actually developed systems and sources in place. In general, this tactical move not just improves functional effectiveness however also positions local business for sustainable development, permitting them to designate resources more properly.

Developing a Partnership: Collaborating With Your Accountant

Effective cooperation with an accountant depends upon solid communication and plainly defined expectations. By establishing a transparent discussion, local business owner can harness important financial insights that drive informed decision-making. This collaboration not just improves monetary administration yet also adds to the overall success of the service.Communication Is Key

Developing a strong line of interaction between an organization owner and their accountant lays the foundation for a successful monetary partnership. Open discussion fosters openness, enabling both parties to share crucial details regarding monetary objectives, difficulties, and approaches. Regular discussions enable the accountant to recognize business dynamics and customize their solutions as necessary. Furthermore, prompt updates on economic issues can aid the proprietor make educated decisions. Active listening is vital; it ensures that both the service owner and accountant feel valued and comprehended. This collaborative approach not just improves trust fund however also causes much more efficient analytical. Inevitably, maintaining regular communication equips both parties to adapt to changing situations, driving the organization towards continual success.Establishing Clear Assumptions

Clear expectations act as an important part in cultivating an effective relationship between an entrepreneur and their accountant. By establishing particular duties and deadlines, both events can align their objectives and top priorities. It is essential for entrepreneur to express their demands plainly, consisting of the regularity of reports and the level of information called for. Furthermore, bookkeepers should communicate their procedures and any kind of restrictions in advance. This good understanding assists avoid warranties and misconceptions timely economic management. Regular check-ins can additionally reinforce these assumptions, permitting for adjustments as the service develops. Inevitably, establishing clear expectations grows depend on and responsibility, allowing an unified partnership that supports the overall success of business.Leveraging Financial Insights

While numerous entrepreneur may view their bookkeepers only as number crunchers, leveraging economic understandings can transform this relationship right into a tactical collaboration. By actively working together with their accountants, small company owners can get a deeper understanding of their economic health and make notified decisions. Accountants possess beneficial competence in determining trends, managing cash money flow, and maximizing budgets. Routine communication enables the sharing of understandings that can highlight opportunities for development or cost-saving actions. Furthermore, bookkeepers can assist in setting sensible monetary goals and tracking progression, making sure that business proprietors remain answerable. Ultimately, cultivating this partnership encourages small company proprietors to browse difficulties better and seize possibilities for long-lasting success.Regularly Asked Inquiries

What Qualifications Should I Look for in a Bookkeeper?

When seeking a bookkeeper, one ought to focus on credentials such as pertinent certifications, proficiency in accounting software application, strong interest to information, and experience in handling monetary records, guaranteeing compliance with policies and helping with precise monetary reporting.Exactly how Typically Should I Consult With My Accountant?

Consulting with a bookkeeper monthly is typically suggested, permitting timely updates on economic standing and any type of essential changes. Nonetheless, even more regular meetings may be useful during hectic periods or when considerable changes occur.Can a Bookkeeper Aid With Payroll Handling?

Yes, an accountant can assist with pay-roll handling. They manage employee documents, determine wages, and warranty precise tax obligation reductions, helping companies preserve conformity and streamline pay-roll operations efficiently, thereby decreasing the management worry on proprietors.What Software Devices Do Bookkeepers Generally Make Use Of?

Bookkeepers typically utilize software program devices such as copyright, Xero, FreshBooks, and Sage. These systems promote accounting tasks, enhance economic reporting, and boost overall performance, permitting bookkeepers to take care of economic records properly for their clients.How Do I Select Between Employing Outsourcing or internal Accounting?

Knowledge with financial declarations, such as income statements and equilibrium sheets, allows service owners to examine success and economic stability. Precise monetary documents serve as the foundation of a small company's economic health. Developing a strong line of interaction between an organization owner and their accountant lays the foundation for an effective monetary collaboration. By proactively teaming up with their bookkeepers, tiny business proprietors can gain a get more info deeper understanding of their economic wellness and make informed decisions. Additionally, bookkeepers can aid in setting practical monetary objectives and tracking progression, ensuring that business owners continue to be accountable.

Report this wiki page